Crowdfunding is a great way of raising capital by start-ups that happily choose such kind of financing rather than traditional methods like taking credit, applying for VC or going public. It gives a great opportunity for small businesses not only to collect money but also to receive priceless feedback from potential customers. Nevertheless, crowdfunding has many drawbacks, both for beneficiaries and investors. That’s way, a former VC consultant, Piotr Pisarz came up with an idea of revolutionizing the ways of financing promising businesses, in every stage of their activity.

According to the co-founder of Uncapped, the VC funds typically invest only in few start-ups a year that after a time-consuming process of screening and analysis are expected to succeed and finally become a unicorn. Meanwhile, many other, innovative and creative ideas are being rejected and lose an opportunity to work out their way to success. To help them, the revolutionized concept of funding has been created by Polish and British entrepreneurs.

However, Uncapped is not exactly a fund. They describe themselves more as creditors, who already experienced the rigour of bank and VC funding systems.

The entrepreneurs were able to create a revenue prediction system that allows to automatically make an offer in only 24 hours. The only actions that an applicant has to undertake are signing up on the fund website and connecting its sales & marketing accounts (with the usage of platforms like Stripe, Shopify and Facebook). All this takes approx. few minutes – there has never been an easier way to raise capital for company development before.

Since their evaluation system is based on a set of tailored algorithms, the only requirements the company has to meet are at least 6 months of trading, over 10£ monthly revenue and an online model such as e-commerce, SaaS or D2C.

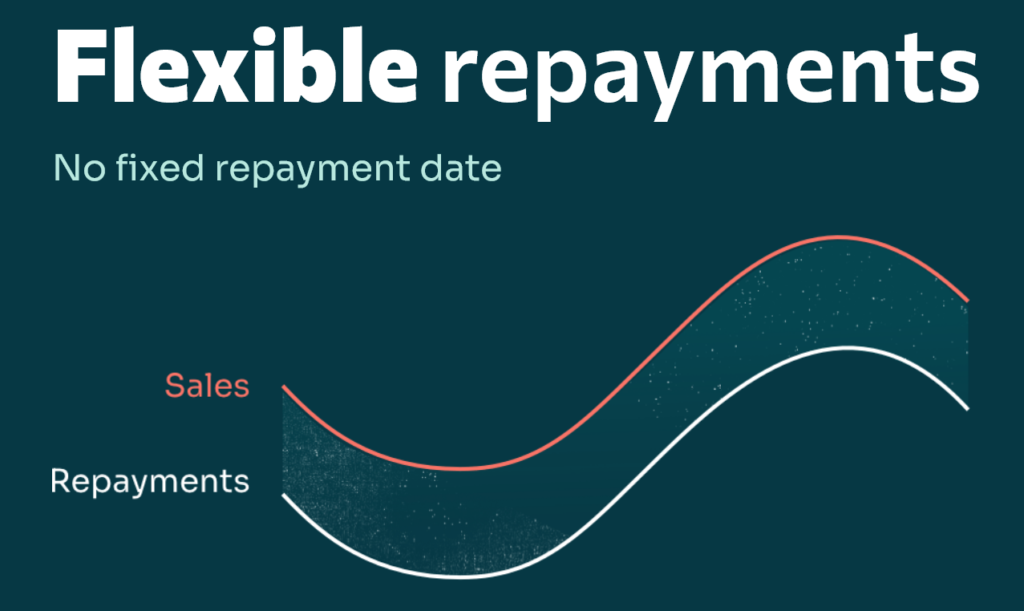

Another advantage that Uncapped has over VC is the flexible repayment program, which makes the borrower repay a fixed percentage of daily sales until the total amount including definitive flat fee is recouped. There is no repayment date and in case the revenue drops, so do the repayments.

The custom algorithms made impossible come true. Uncapped can provide capital to hundreds of companies annually thanks to a well-established system of the automatic forecast of one’s revenue. Offered funding ranges from £10k – £2M, based on companies needs and repayment capabilities. That’s the first European revolutionary fund with great forecasts for further expansion.

Sources:

https://www.weareuncapped.com/

https://mycompanypolska.pl/artykul/uncapped-czyli-nieograniczony-rozwoj/3875